Spendee App

Description

Managing your personal finances doesn’t have to be complicated. With the Spendee app for Android, you get a user-friendly and powerful budget tracker designed to help you stay on top of your income, expenses, and savings goals. If you’re looking to download the Spendee APK for Android, this guide provides everything you need to know.

What is Spendee?

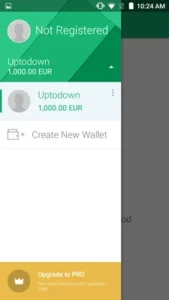

Spendee is a finance and budgeting app that simplifies money management by providing clear insights into where your money goes. It allows users to connect their bank accounts, categorize expenses, and set custom budgets. Whether you’re trying to cut down on subscriptions or save for a vacation, Spendee makes your financial journey more manageable.

Features of Spendee for Android

Here are some of the standout features you can enjoy with the Android version of Spendee:

-

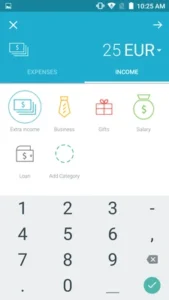

Intuitive Interface – Easily navigate through budgets, categories, and transactions.

-

Multi-Currency Support – Track spending in different currencies for international users.

-

Bank Sync – Connect your bank accounts to sync transactions in real time.

-

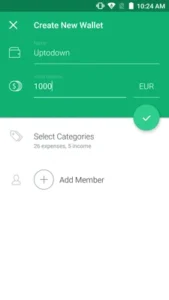

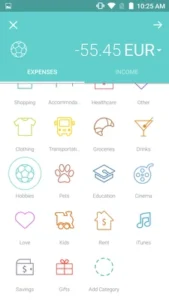

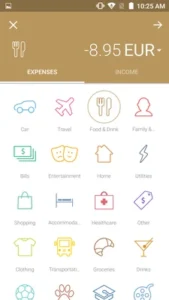

Custom Budgets – Create personalized budgets for categories like groceries, bills, or leisure.

-

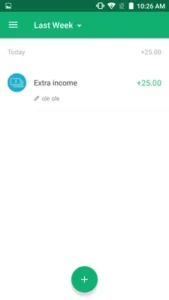

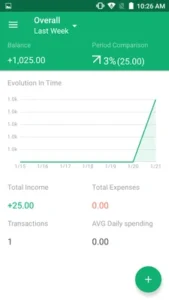

Spending Insights – Visual reports and analytics that help you make better financial decisions.

-

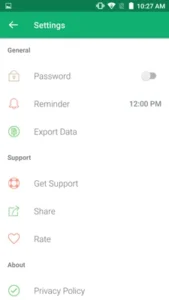

Secure and Private – End-to-end encryption ensures your financial data stays safe.

Why Download the APK Version?

If you’re unable to access Spendee via the Google Play Store or prefer manual installation, downloading the Spendee APK for Android is a convenient option. The APK gives you full access to the app’s latest features without waiting for regional availability or device limitations.

How to Download and Install Spendee APK on Android

Follow these steps to download and install the Spendee APK safely:

-

Download the APK File – Visit a trusted APK site and search for “Spendee for Android.”

-

Enable Unknown Sources – Go to

Settings > Securityand allow installation from unknown sources. -

Install the APK – Open the downloaded file and follow the on-screen instructions.

-

Launch the App – Once installed, log in or create an account to begin managing your budget.

⚠️ Note: Always download APK files from reputable sources to protect your device from malware.

Is Spendee Safe to Use?

Yes, Spendee is trusted by thousands of users globally. It uses strong data encryption, offers privacy controls, and does not share your financial data without consent. The APK version is equally safe when downloaded from verified platforms.

Frequently Asked Questions (FAQs)

Q1: Is Spendee APK free to download for Android?

Yes, the basic version of the Spendee APK is free to download and use. It offers essential budgeting tools and spending insights. However, there are optional premium features available through in-app purchases.

Q2: Can I sync Spendee with multiple bank accounts?

Absolutely. Spendee supports multi-bank syncing, allowing you to view all your transactions in one place. This feature is available in the premium version.

Q3: Is it safe to use the APK instead of downloading from Google Play?

As long as you download the Spendee APK from a reputable site like APKMirror or APKPure, it’s generally safe. Always ensure you’re installing the latest, verified version and avoid third-party modded APKs.

Q4: Will I receive updates if I use the APK?

If you’re not using the Google Play Store version, you’ll need to manually download and install new versions of the APK when they’re released. Make sure to check trusted sources regularly.

Tips for Better Budgeting with Spendee

Here are some quick tips to get the most out of Spendee on Android:

-

Set Financial Goals: Use Spendee’s goal-setting feature to plan for big expenses like travel, a new gadget, or emergency savings.

-

Track Cash Expenses: Don’t forget to manually log cash purchases so your records remain accurate.

-

Use Categories Wisely: Customize and color-code categories to better reflect your personal habits.

-

Review Weekly: Take 10 minutes every Sunday to review your spending and adjust your budgets accordingly.

Images